There’s a brutal truth in the market:

No one praises you for stepping aside at the right time.

If you sell before the market runs another 10%, people laugh at you for being “too scared.”

But if you get trapped and lose 70%, no one comes to rescue you.

That’s why the true goal of a long-term trader is not to catch every wave,

but to preserve capital long enough to have a chance to come back.

The distribution phase is one of the toughest trials.

But if you know how to observe it, you can:

-

-

Avoid becoming a victim

-

Protect both your capital and your mindset

-

Even take advantage of it to profit while the crowd is still dreaming

-

1. Set Personal “No-Entry Zones”

In investing, most people spend all their time learning when to buy.

Very few bother to train themselves on when they must absolutely not buy.

Yet it’s this second skill that is truly life-saving.

A wise investor isn’t the one who catches every opportunity,

but the one who stays away from danger zones—

where most of the crowd ends up stuck or losing money.

There are three no-entry zones you need to burn into instinct:

First: Don’t Buy at the Previous High

This is the favorite area for whales to distribute.

When price approaches an old top:

-

Media hypes it

-

Communities get excited

But remember:

Right there, massive sell orders are quietly being executed.

Buying at the top is like walking into a casino when the game is almost over.

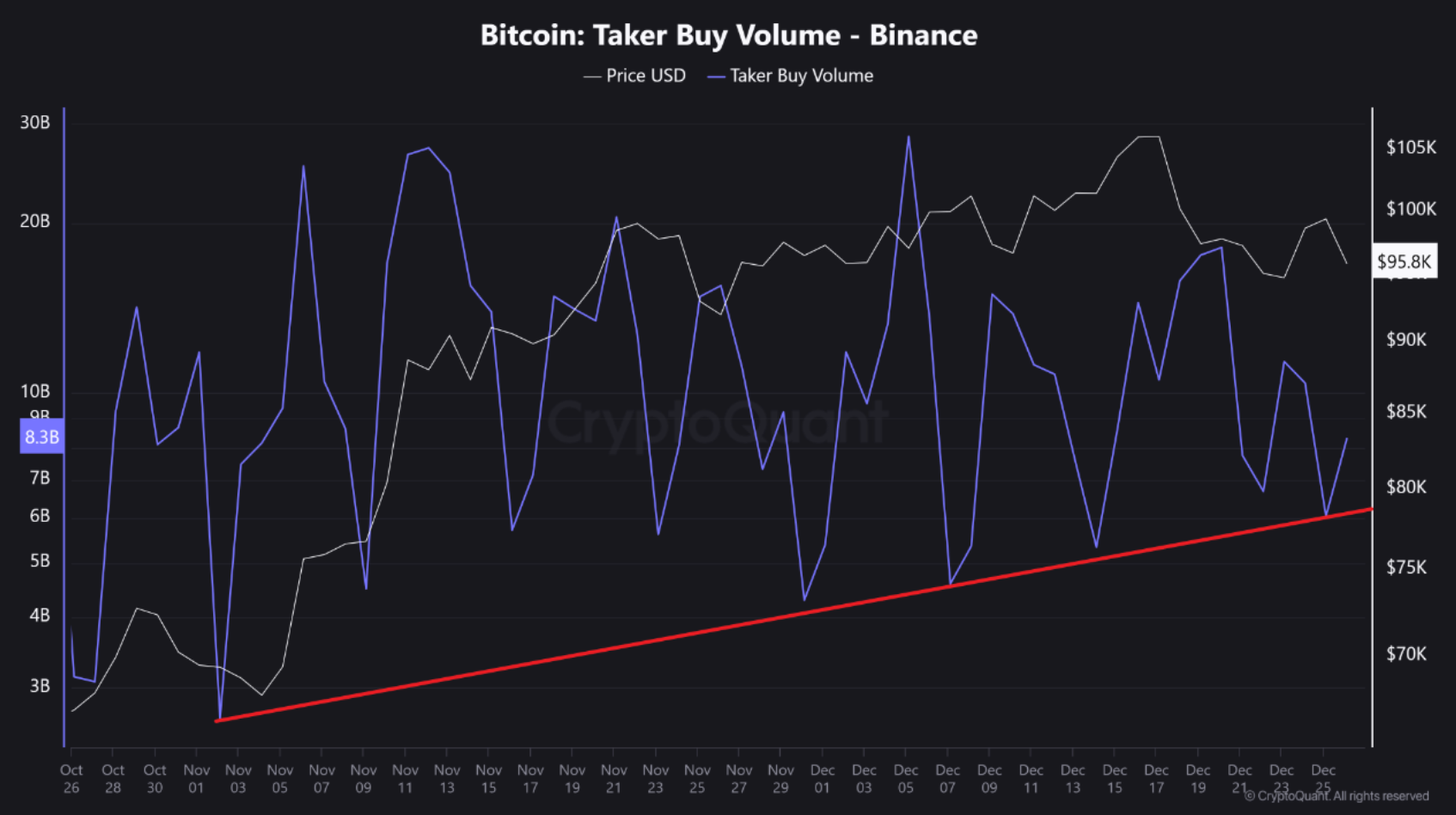

Second: Don’t Buy When Volume Increases but Price Fails to Break the High

This is one of the most subtle signals.

Many see big volume and immediately think,

“Strong money is coming in.”

But if price still can’t break out,

it means real buying power is no longer there,

and that much of that volume comes from selling pressure

being absorbed by impatient, late buyers.

If you insist on buying at that moment,

you’re simply turning yourself into liquidity

for whales to exit.

Third: Don’t Buy When the Market Is Too Noisy

When everyone is talking about a certain coin,

when group chats are flooded with memes,

when KOLs keep shilling it non-stop—

be careful: you may be in a distribution zone.

Whales only need one thing to exit smoothly:

the blind faith of the crowd.

And the louder and more euphoric the crowd is,

the more perfect the environment becomes for unloading bags.

These rules may sound simple,

but that simplicity is your very first shield against whale traps.

The market doesn’t demand that you win every trade.

It demands that you avoid the fatal blows.

If you protect capital and stay away from no-entry zones,

you’ve already outperformed 70% of investors out there—

those who keep buying right where whales are selling.

2. Read Volume Like a Doctor Reads an ECG

In medicine, an experienced doctor doesn’t wait for the patient to scream in pain.

Just by reading the heart rate monitor,

they can spot danger well before a crisis hits.

Trading is the same.

The market always leaves footprints.

Volume is its ECG.

Most traders only look at candle colors:

Green = happy, Red = worried.

But for someone who understands volume,

color is just surface.

What matters is the heartbeat inside—

whether money is flowing in or flowing out.

Imagine:

Volume Rises but Price Stagnates

It’s like a heart suddenly beating faster,

but blood fails to circulate properly.

That means big money is in the game,

but not to push price up—

they’re using the liquidity to exit.

That’s a textbook sign of distribution.

Volume Gradually Falls While Price Keeps Rising

Like a patient still managing to walk,

but whose heartbeat is getting weaker, lacking vitality.

The uptrend is running out of fuel.

Fresh buying is gone.

Price is still rising,

but like a car rolling downhill without an engine—

it’s no longer truly powered.

This is often when whales silently pull out.

Volume Explodes on a Breakout But Price Fails to Hold

A sudden spike in heart rate, then arrhythmia,

followed by collapse.

This is the classic bull trap—

a psychological setup designed to suck out remaining liquidity.

You think the market is exploding with life,

but in reality, that’s the heartbeat of a system on the verge of stroke.

Build the Habit of Watching Volume

Don’t look at the chart as a static picture.

Take notes on volume every day:

-

Today price went up—what happened to volume?

-

Yesterday there was a breakout—did volume support the move and hold?

-

During sideways action—is volume thick or thin?

After a few months,

you’ll be surprised to see patterns repeating

just like a human heartbeat.

The market has:

-

accumulation beats

-

distribution beats

-

bull trap beats

-

final flush beats

If you observe long enough,

you’ll notice those “abnormal rhythms”

before a shock occurs.

Once you’ve trained yourself to “read the market’s ECG,”

healthy skepticism at the right moment becomes instinctive.

You don’t need anyone to warn you.

You don’t need to be a prediction genius.

When price and volume stop agreeing with each other,

you’ll know something is happening behind the curtain.

3. Learn to Stay Out – The Skill No One Teaches You

In the market, everyone teaches:

-

how to enter

-

how to catch bottoms

-

how to ride breakouts

-

how to use margin

Almost no one teaches you how to stand aside.

Yet standing aside is one of the most critical survival skills.

Staying flat doesn’t mean you’re scared.

It means you can see the blood starting to spill.

You don’t need to catch every wave.

You just need enough capital to ride the next one.

An old trader in Singapore once told me:

“I don’t need to buy the bottom.

I just need to sell before the bloodbath.”

That’s not cowardice—

it’s wisdom paid for with an entire fortune lost in the past.

4. Turn Distribution into Opportunity

Most beginners see distribution as a graveyard:

-

portfolios bleeding out

-

faith shattering

-

“to the moon” dreams burnt into charcoal on the chart

But for experienced traders,

distribution is not the end.

It’s opportunity.

Sometimes it’s the most valuable training ground

for skill and mental toughness.

Beginners fear the blood.

Veterans calmly ask:

“Whose blood is that?

Is it mine?”

If you can read the signs of distribution,

you don’t have to be a victim.

You can use this very phase as a springboard.

Shorting – Walking Against the Crowd

When distribution signals become clear:

-

Price moves sideways at the top

-

Volume is unusually heavy

-

Good news keeps coming but price doesn’t move

-

Breakouts keep failing

That’s when many professional traders start opening short positions.

While the majority either stay euphoric

or stubbornly “HODL,”

those who are clear-headed bet in the opposite direction.

Distribution is not just a selling phase—

it’s the setup for the next dump.

And if you short at the right time,

you can profit while the crowd still doesn’t understand what’s happening.

Hedging – Holding Coins Without Sacrificing Capital

Not everyone wants to sell their long-term holdings,

especially if they still believe in the project.

But belief doesn’t mean

you must let your capital drown in a distribution wave.

Experienced investors often hedge using futures.

You can:

-

Keep your spot coins in your wallet

-

Open a short position to offset risk

If price crashes, profit from the short can offset losses on spot.

If price unexpectedly recovers,

your spot holdings are still there.

This is a defensive art whales use all the time,

while most retail traders ignore it,

too busy clinging to “beautiful narratives.”

Exit to Wait for the Next Accumulation

Sometimes, the best opportunity is not to “trade the distribution,”

but simply to exit safely and wait for the next accumulation phase.

The market is an endless cycle:

Accumulation → Expansion → Distribution → Collapse → Accumulation again.

Beginners get stuck in distribution

because they refuse to accept that something is ending.

Veterans exit, stay on the sidelines,

and patiently wait for the next cycle.

I once sold my entire portfolio

when I saw Bitcoin moving sideways at the top with heavy volume.

Many laughed, saying I was too cautious.

Three months later, the market had dropped over 50%.

While many friends blew up their accounts,

I used my preserved capital to buy altcoins at deep accumulation levels.

One rebound wave was enough to double my account.

The lesson is crystal clear:

Exiting at the right time is more important than buying the exact bottom.

Real Example: Solana 2021

Late 2021, Solana was the hottest name in the market.

Price rocketed from tens of dollars to over $250 in just a few months.

-

Communities went wild

-

Media called Solana the “Ethereum killer”

-

Funds kept announcing investments

-

Twitter and Telegram overflowed with praise

But if you looked closely,

late 2021 was a textbook distribution phase for SOL:

-

Price moved sideways for a long time in the 200–250 USD zone

-

Volume was heavy, but bullish momentum weakened

-

Every breakout attempt failed

-

Each bounce to the high was hit with strong selling

-

Meanwhile, bullish news kept pouring in

The result?

After distribution completed,

SOL dropped to below 100 USD within a few months,

then continued bleeding down under 20 USD in the bear market,

eventually bottoming around 8 USD.

Those who believed the hype and held near the top

were almost completely wiped out.

Those who exited early during distribution

had the chance to accumulate

at prices 10 times lower.

Just one recovery wave from that bottom

was enough for huge returns.

This example shows clearly:

Distribution is not only a capital-killing trap.

It is also a golden opportunity

for those who can observe and be patient.

Key Lesson

Distribution is not just a death sentence for the naive.

It’s a phase where power gets reallocated in the market.

-

Those who lose capital are pushed out of the game.

-

Those who preserve capital enter the next cycle with a huge edge.

Whales understand this.

You must learn to see the market through their eyes:

Cold.

Disciplined.

And always aware that sometimes,

exiting is the biggest win.

5. Keep a Market Journal – Train Your Eye (Expanded)

In trading, most people make the same mistake:

They watch but don’t record.

They sit in front of the screen,

get excited when price pumps,

panic when it dumps,

then forget everything the next day

and repeat the emotional cycle.

Month after month.

No distilled experience.

The simplest and most powerful way to break this loop

is to keep a market journal.

Every day, just a few lines about the essentials:

-

How did today’s volume compare to yesterday’s?

-

How did price behave around key support/resistance zones?

-

Was there any major news? Did price move in line with it?

-

Most important: what were your emotions while watching the chart?

Excited? Worried? Doubtful? Calm?

At first, it feels time-consuming and pointless.

But if you stick with it for a few months,

you’ll see something remarkable:

The distribution pattern becomes less fuzzy.

Sideways phases, fake breakouts, bull traps, dead volume—

they will appear as familiar cycles.

Like a doctor reading ECGs,

you’ll start seeing the “heartbeat” of the market:

-

“We had a sideways like this three months ago…”

-

“There was also a failed breakout with heavy news back then…”

-

“What happened next? The market crashed.”

That memory—built from journaling—

gives you market intuition.

Next time the pattern reappears,

you won’t panic.

You’ll act.

The Result of Patience

After a while, you’ll reach a different state:

You don’t fear distribution anymore—

because you’ve seen it too many times.

You know how it forms.

You know how it behaves.

You understand it’s not the end of the world,

just another phase in the cycle.

Then you’re no longer the panicked prey inside the trap.

You’re the observer,

patiently waiting for your chance.

A market journal is your tool

for training a “third eye”—

one that sees beyond the chart

into the real flow of money.

Once that eye is trained,

you no longer depend on rumors or predictions.

You act based on truth.

6. Silence – The Ultimate Weapon

During distribution, the market is always noisy.

-

Chats explode

-

KOLs post non-stop

-

Twitter is full of “to the moon”

Everyone argues.

Everyone thinks they’re right.

Everyone is convinced their coin will go even higher.

The louder and more euphoric it gets,

the more intensely whales are unloading.

But among that noisy crowd,

the longest survivors share one trait:

They’re quiet.

They don’t jump into pointless debates.

They don’t rush to call the next move.

They don’t try to convince others to buy or sell.

They just:

-

Sit still

-

Observe calmly

-

Record price and volume behavior

While others get swept away by every 3–5% pump,

they only care about where the real money is flowing.

Silence to Avoid Manipulation

This silence isn’t apathy.

It’s discipline.

When you stay silent,

you’re less likely to be dragged by FOMO.

You’re less likely to panic at sudden red candles.

You detach yourself from herd psychology—

and that detachment lets you see the market more clearly.

In trading, winners are not those

who predict the future best,

but those least controlled by emotion.

Silence is how you cut the invisible thread

that ties you to the crowd.

When Silence Becomes Strength

An investor once told me:

“The day I stopped arguing in chat groups

was the day I started making money.”

When you no longer feel the need to prove anything,

you can see the market as it truly is:

Just a game of capital flow.

When you reach that state,

distribution stops being a catastrophe

and becomes just another recurring play.

You’ve seen it before.

You recognize it again.

You wait for its end.

You’re no longer the prey running in circles;

you’re the one watching from outside the cage.

That silence—

the refusal to be driven by greed or fear—

is your ultimate weapon.

It gives you the greatest edge of all:

the patience to wait for the next cycle.

:max_bytes(150000):strip_icc()/StockTraderDefinitionTypesVs.StockBroker-2f2fe4ba7f14437ab75c6ac462bbeb85.jpg)