Volume – The Primitive Language of the Market

In the world of finance, almost everything can be fake.

Price can be pushed up or smashed down by a handful of big players.

News can be scripted like a stage play, sometimes crafted purely to serve the interests of a small group.

Technical patterns, complex indicators, and the endless “to the moon” or “bear market” posts on social media can all be echoes of manipulation.

But in that noisy ocean, there is one thing that never lies: trading volume.

Volume doesn’t care about empty promises.

It doesn’t get shaken by influencers “shilling” on X or YouTube.

It can’t be disguised by colorful candlesticks.

It only records one simple truth:

how much real money is flowing in, and how much real money is flowing out.

You can lie with words.

You can’t lie with actions.

And volume is the footprint of those actions.

(Note: This is a long piece. Take the time to read it all – and read it multiple times – to truly absorb its value.)

Price Is the Shadow, Volume Is the Real Body

You see a long green candle appear—price jumps 10%.

You get excited. You think the market is about to reverse.

But if volume is low, that move is just a shadow—a trap laid by whales.

On the other hand, sometimes price moves sideways for weeks, looking “dead,” but volume quietly increases.

That’s the real body moving.

That’s the silent footsteps of whales accumulating.

Over the years, I’ve noticed a clear difference between those who survive long term and those who get crushed.

-

Survivors listen to volume.

-

Losers only stare at price.

Price is an illusion.

Volume is the truth.

A Strange but Life-Saving Habit

I once knew an older trader.

He wasn’t a flashy millionaire, nor a social media celebrity.

But he had a strange habit:

For more than ten years, every single day, he spent at least one hour looking only at volume—not price.

He could sit for weeks watching a coin move sideways in boredom.

But the moment he saw an unusual surge in volume, he would act—instantly.

No hesitation.

And most of the time, he was right.

He didn’t FOMO.

He didn’t need news.

He didn’t need anyone’s opinion.

He just listened to the heartbeat of the market.

I once asked him what his secret was. He smiled:

“Price is noise. Volume is signal.”

Simple answer.

Enough for me to carve it into my memory.

The Trap of Price and the Truth of Volume

Most investors suffer the same tragedy:

They buy the top and sell the bottom.

They jump in when the market is overheated.

They run away when the market has already bottomed out.

Why?

Because they only look at price—and believe in rumors.

Whales—those with huge capital—understand crowd psychology perfectly.

They don’t need to make announcements.

They pump to trigger your FOMO.

They dump to trigger your panic.

But every script they write leaves a trace they cannot erase: volume.

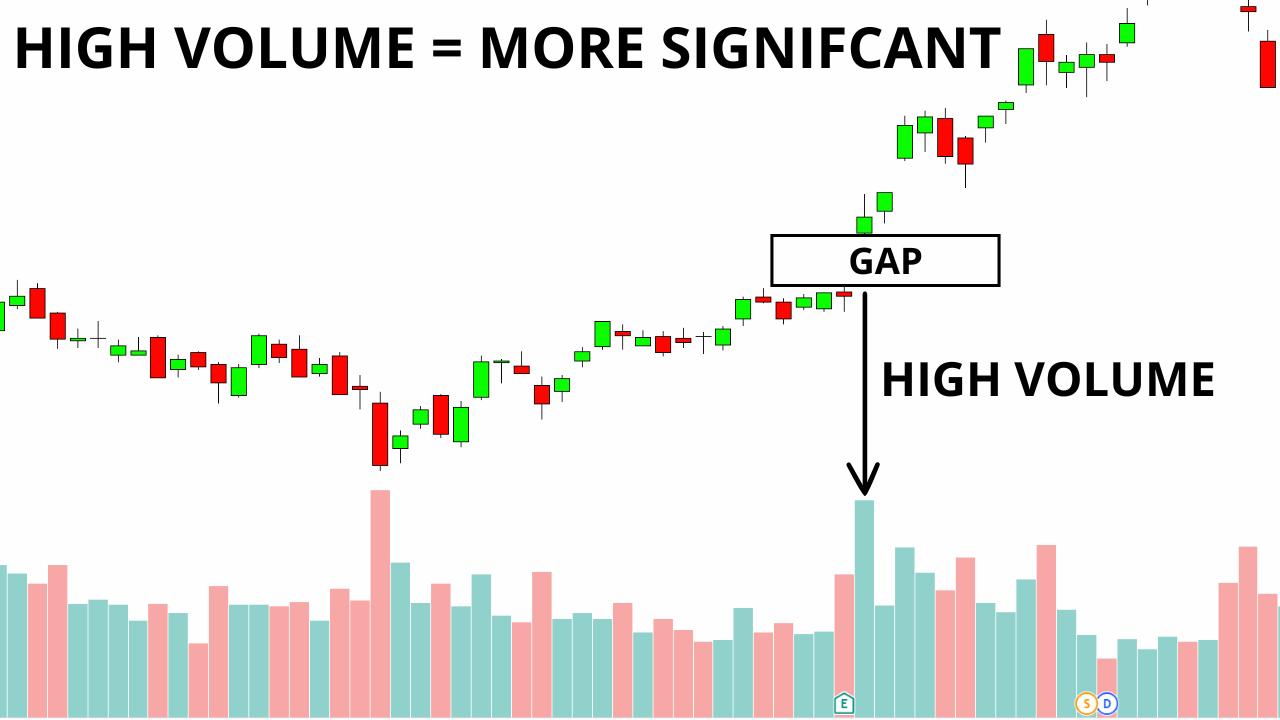

Fake Breakouts vs. Real Breakouts

One of the most painful lessons I ever learned came from trading a head-and-shoulders reversal.

Price broke the neckline.

I went heavy on shorts.

But volume was dropping.

I ignored that.

Result? My short got liquidated.

Because a breakout that isn’t backed by volume is just bait.

-

Fake breakout: price rises, but volume doesn’t follow.

-

Real breakout: price rises and volume explodes after a period of accumulation.

If you only look at price, you’ll be fooled.

If you watch volume, you’ll see the truth.

Fake Pumps vs. Real Accumulation

During the NFT mania a few years ago, I watched countless tokens go 10x, 20x in just weeks.

Everyone was screaming, livestreaming, posting “to the moon” everywhere.

But I exited early—not because I had insider info, but because I saw volume weakening.

Price was still going up, but volume was drying up.

Whales had already left.

Only the crowd was left inflating the bubble.

When liquidity finally dried up, the bubble burst.

On the flip side, I’ve seen coins nobody cared about, moving sideways for months.

But volume steadily increased—first a few hundred thousand dollars, then a few million.

Price hadn’t moved yet, but real money was flowing in.

That’s accumulation.

When they finally broke out, they went up 300–400% in just a few days.

If you only look at price, you miss them.

If you watch volume, you see the opportunity.

Volume – The Market’s True Voice

Whales never leave messages saying, “We’re buying now.”

But every time they act, volume tells on them.

-

When they accumulate, volume rises slowly, steadily.

-

When they distribute, volume balloons, candles have long wicks, and price stalls.

-

When they trigger panic selling, volume explodes at the bottom.

You don’t need to guess.

Volume will tell you.

Volume and the Market’s Unchanging Cycle

If there’s one rule every seasoned investor agrees on, it’s this:

Every asset moves in cycles.

That cycle is like the breath of a giant creature—inhale, exhale; expand, contract.

And the clearest way to track that rhythm isn’t price—it’s volume.

1. Accumulation Phase – When Whales Quietly Load Up

Picture an unknown coin, nobody talking about it, flat price action for months.

The crowd is bored.

KOLs are silent.

Telegram groups have only a few people sighing.

But if you watch volume, you’ll see something else:

Session by session, volume creeps up—gently, consistently, without noise.

First a few hundred thousand, then a few million.

Price hasn’t moved yet—but money has.

That’s whales accumulating.

They don’t buy when the crowd is excited.

They accumulate when everyone has lost patience.

And that patience is where their power comes from.

Amateur traders leave because “this coin has no momentum.”

Professional traders smile and wait—because they hear footsteps in the dark.

2. Markup Phase – When the Crowd Piles In

After accumulation comes liftoff.

Price starts to climb.

Volume surges.

News appears.

Communities wake up.

KOLs stream.

Twitter is flooded with “to the moon.”

This is when whales begin distributing their bags.

The crowd thinks the rally has just begun.

Reality: the move started months ago—and volume already signaled it.

3. Distribution Phase – When Whales Quietly Exit

This is the most dangerous phase.

Price is still high, maybe even making marginal new highs.

Volume is heavy, sometimes massive.

But if you zoom in, you’ll see long wicks and no real progress in price.

This is whales offloading to euphoric retail.

They no longer need higher prices—they just need other people to believe price will keep rising.

When that belief peaks, whales are already gone.

4. Markdown Phase – When Panic Selling Hits

After distribution, the market falls.

Volume spikes again—but this time from fear, not greed.

Everyone is cutting losses.

Sell orders flood the books.

Cries of pain fill the community.

This is when whales finish the game.

They sold at the top.

Now they calmly wait to buy back from desperate sellers.

The story repeats.

A new cycle begins.

And every time, volume leads price.

Volume – The Battle Map of Capital Flow

The market is like a battlefield.

Price is the sound of gunfire.

Volume is the map showing where the real fighting happens.

1. High-Volume Zones – The Real Battlefield

A price zone with heavy, concentrated volume is where major battles took place.

That’s real support or resistance.

If price returns to that zone, it won’t easily break—because many positions are anchored there.

Experienced traders always pay attention to volume profiles—how volume is distributed by price levels.

Where volume is thick, that’s where the real war happened.

2. Low-Volume Zones – The Soft Gate

Conversely, some price zones have almost no volume.

The market never cared much about them.

When price enters these zones, it can slice through quickly—like moving through air.

One deadly mistake new traders make is placing stop-losses in low-volume zones.

Whales know this.

They can easily “stop hunt” with a fake push, then reverse.

Volume helps you distinguish strong zones from weak ones.

3. Volume – The Trace of Intent

Volume doesn’t just show money.

It reveals intent.

-

Price up, volume down → weak move, unsustainable trend.

-

Price down, volume down → mild correction, no real capitulation.

-

Price down, volume exploding → real panic, true flush.

-

Price sideways, volume rising → stealth accumulation, big move loading.

Always remember: real intent is expressed with real money.

Volume is the footprint of that money.

4. Volume – The Rearview Mirror

People often ask, “How do I know which coin whales are buying?”

Simple: watch volume.

No one can deploy hundreds of millions into an asset without leaving a trace.

Volume is a rearview mirror.

It shows you what has already been done.

And when cycles repeat, that past often becomes your future.

Volume and Crowd Psychology

Financial markets are not just a numbers game.

They are a mirror of human psychology.

Price is the visible expression of emotion.

Volume is the force behind those emotions.

1. Volume – The Bloodstream of Fear and Greed

When markets are euphoric, volume explodes.

That’s millions of people throwing money in, believing “the train is just starting.”

When markets are in panic, volume also explodes—

but this time it’s blood pouring out of open wounds: panic selling.

The interesting part?

Whales are always ahead of both.

They accumulate when you’re bored.

They distribute when you’re ecstatic.

They buy back when you’re terrified.

The cycle repeats over and over.

The crowd still doesn’t learn.

2. Fake Pumps and Psychological Traps

I remember a time when the altcoin market was “on fire.”

A small-cap token rose for five days in a row.

Communities were buzzing.

Everyone called it a “once-in-a-lifetime gem.”

But volume said otherwise:

Every day price climbed, volume shrank.

Classic fake pump: price pushed up with thin orders; big money wasn’t interested.

A week later, the token crashed 60%.

That taught me:

Euphoria without supporting volume is an illusion.

3. The Silence of Volume

Other times, the market is silent.

Price drifts sideways.

Communities are quiet.

But volume slowly ticks up, little by little—like a faint drumbeat in the dark.

That’s when whales are sketching a new plan.

Silence from the crowd is opportunity for them.

If you’re observant, you’ll realize:

Silence is not emptiness.

It’s preparation.

Trading Strategy with Volume

Volume is not just a tool for observation.

It’s a foundation for simple yet powerful trading strategies.

Over the years, I’ve tested many systems.

Complex ones, layered indicators—but in the end, I found volume-based strategies to be the simplest and most honest.

1. Accumulation – Buying Quietly

First strategy: watch for accumulation.

If a coin moves sideways for a long time, but volume gradually increases, that’s a sign of accumulation.

You don’t need to enter immediately—but you should prepare.

Strong breakouts often follow these phases.

2. Distribution – Selling into Noise

When price has risen significantly and volume is huge, be careful.

If you see long wicks, stalled price action, but heavy volume—that’s distribution.

Whales are unloading into retail excitement.

This is not the time to FOMO in.

It’s the time to leave.

3. Climax – Volume Peaks at Tops and Bottoms

There’s a classic pattern: Volume Climax.

-

After a long uptrend, a sudden massive surge in volume—5x to 10x the average—accompanied by a spiky or rejection candle → often marks the top.

-

After a brutal downtrend, when everyone gives up and volume suddenly explodes → that may mark the bottom.

In 2018, Bitcoin fell from 20,000 to around 6,000, then finally to 3,200 with a huge volume spike.

That was the historic bottom.

Volume signaled it before the news caught up.

4. Divergence – When Volume and Price Disagree

One of the most subtle but powerful signals is divergence between price and volume.

-

Price makes a new high, but volume is lower → buying power is fading, trend is weak.

-

Price makes a new low, but volume is higher → selling pressure may be climaxing, downtrend may be near exhaustion.

This is how you go against the crowd, rationally.

When everyone believes the trend will continue, volume quietly whispers a different story.

5. A Simple but Deadly Rule

At one point, I tested an extremely simple strategy:

Only trade when volume is at least 2x the 20-day average.

No matter the coin.

No matter the news.

The result?

Win rate was higher than most of the complex systems I’d used.

Proof that volume is truly the backbone of trading.

Common Mistakes When Ignoring Volume

Even though volume is visible for everyone to see, most traders keep repeating the same mistakes.

The problem isn’t lack of tools.

It’s lack of patience and clarity.

1. Believing in Price, Ignoring Volume

The most common mistake: seeing a big green candle and jumping in.

Many people treat price as “absolute truth.”

In reality, price without volume is just fireworks—bright but short-lived.

I’ve seen countless coins pump 30–40% in one day.

Everybody rushed in.

But a quick glance at volume showed that trading activity was tiny compared to average.

A week later, price collapsed.

People blamed whales.

But volume had warned them from the start.

2. Believing News

Another mistake: chasing news.

A project announces a partnership.

An exchange lists a new token.

Communities cheer.

Price jumps.

But if volume doesn’t follow, that move is just empty news.

News is the script.

Volume is the action.

If news is good but volume isn’t there → big money isn’t buying it.

If news is bad but volume is low → there’s no real panic yet.

3. Overusing Indicators

The trading world is flooded with indicators: RSI, MACD, Bollinger Bands, etc.

But all these indicators derive from price action.

And price can be manipulated.

Indicators are just translations of the shadow.

Volume is different.

It’s not a translation.

It’s the source language.

You can throw away every indicator if you must—but you cannot ignore volume.

4. Lack of Patience

The deadliest flaw: impatience.

Volume doesn’t give signals every day.

Sometimes you have to wait weeks, months.

During that time, you’re easily tempted by other coins, other hypes, new “meta” narratives.

You walk away, and when volume finally explodes where you were watching, you’ve missed the move.

In markets, the patient usually win.

Whales win because they have time.

To move with them, you must learn to wait.

The Survival Philosophy of Long-Term Traders

After many years of scars and lessons, I realized:

Trading is not just technique.

It’s a survival philosophy.

And in that philosophy, volume is the compass.

1. Silence and Observation

The most successful traders I’ve met share one thing: they are quiet.

They don’t brag about entries.

They don’t scream on social media.

They quietly watch volume—and strike when the time is right.

While the crowd argues loudly, they observe money flow.

Silence is their edge.

2. Not Chasing Hype

In every mania—ICO 2017, NFT 2021, memecoins 2023—millions join because of hype.

But every bubble ends the same way: collapse.

The ones who survive are those who listened to volume.

Volume tells you when big money is leaving—even when hype is still at maximum.

3. Going Against the Crowd

Amateur traders buy when everyone buys, sell when everyone sells.

Professional traders do the opposite:

They accumulate when others are bored.

They sell when others are ecstatic.

How can they dare do that?

Not because they’re fearless,

but because they trust volume, not noise.

Volume is the map that shows where the crowd is lost.

4. Volume as the True Measure of Conviction

Anyone can say, “I believe this coin will go up.”

But if they don’t put money in, it means nothing.

Volume exposes who truly believes—and who is just talking.

In a market full of lies, volume is the final witness.

Volume – The Unerasable Footprint of Whales

In the financial jungle, whales always seem to have the upper hand:

They have more capital.

Better information.

Smarter strategies.

But there is one weakness they can never fix:

They cannot move massive size without leaving a footprint.

1. Volume as Footprints in the Sand

Think of a predator in the forest.

It can move silently, but every step leaves a mark on the ground.

Volume is that footprint.

Whales can use hidden orders, algorithms, even wash trading to blur things.

But when they really accumulate, volume rises.

When they distribute, volume swells.

Every manipulation, in the end, must be executed with real money.

And real money leaves volume behind.

2. Real-World Examples

-

Bitcoin 2015:

When BTC dropped to around $200, the community had lost hope.

But volume began to climb, slowly and steadily.

A year later, Bitcoin entered a historic bull run. -

DeFi Summer 2020:

Many DeFi tokens moved sideways, low attention.

Then suddenly volume exploded while price barely moved.

That was whales entering.

Two months later, those tokens had gone up many times. -

NFT 2021:

NFT-related tokens soared.

But volume started to shrink while prices remained high.

One month later, the bubble popped.

Every major move was signaled by volume first.

Most people simply weren’t looking.

3. The Truth About “Insider Information”

Many new traders dream about having “insider info.”

But the truth is, insider info is less important than volume.

Before official news is released, whales have already acted.

And volume has already recorded it.

You don’t need to know the CEO.

You don’t need to be in private groups.

Just watch volume.

It is the earliest, most honest news feed.

Volume Is the Language of Truth

In the end, trading is not just about entries and exits.

It’s about facing the truth in a world full of deception.

And the last remaining piece of truth is volume.

1. The Final Lesson

-

Price can be manipulated → Volume will expose it.

-

News can be staged → Volume will show who really acted.

-

Indicators can mislead → Volume has the final say.

If you want to survive long term, learn to read volume as if it were a new language.

At first, it’s confusing.

But once you begin to “hear” it, you will never see the market the same way again.

2. Survival Philosophy

Trading is not about becoming a genius who predicts the future.

It’s about staying alive long enough in the present.

Those who survive are the ones who:

-

Know how to wait.

-

Know how to observe.

-

Know when to step back when volume doesn’t confirm.

-

Know when to step in when volume leads price.

Whales will always move first.

But volume is the shadow of their actions.

If you’re alert, you will see it.

Whales cannot hide their volume.

And volume never lies.

If you truly understand this, you will no longer be hypnotized by green candles, nor panic over red ones.

You will stop being prey.

You will become the patient hunter—

listening to the heartbeat of the market.

And perhaps, that is the only real path to survival—

and victory—in the financial jungle.